By David Delgado | Freedom Choice Lending

If you’ve ever thought, “I can’t buy a home because my credit isn’t perfect,” you’re not alone.

This is one of the biggest myths keeping buyers on the sidelines — and in many cases, it’s simply not true.

The reality is this:

You don’t need perfect credit to buy a home. You need the right loan strategy.

Let’s break it down clearly, honestly, and without lender jargon.

The Short Answer

Most buyers can qualify to buy a home with a credit score between 580 and 620, depending on the loan program.

Some buyers qualify with even lower scores.

Here’s how it works.

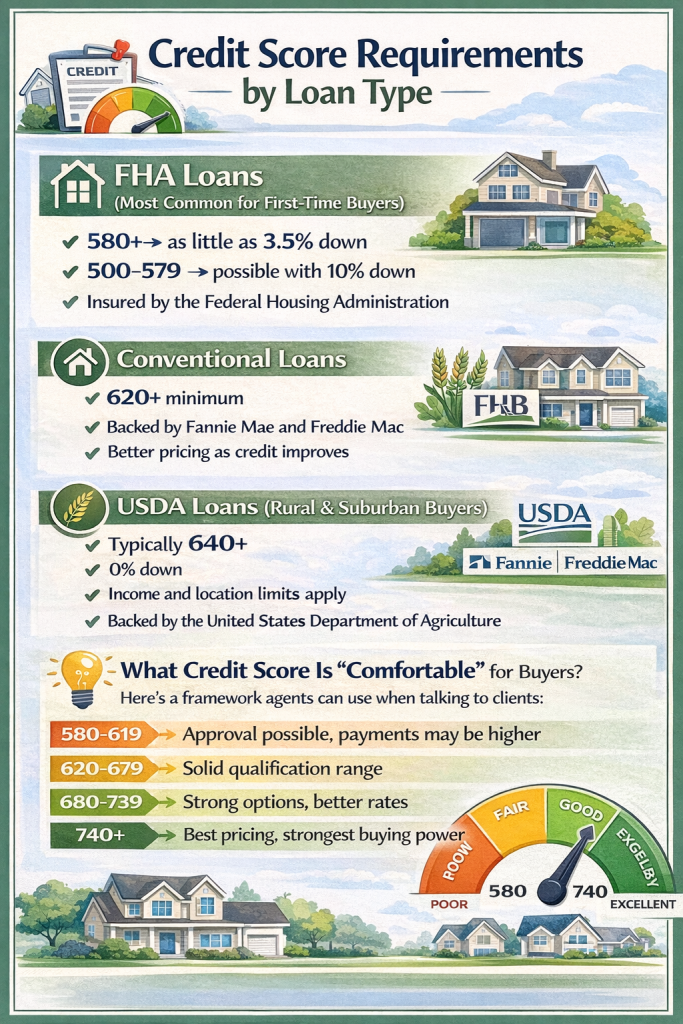

Credit Score Requirements by Loan Type

🏡 FHA Loans (Great for First-Time Buyers)

- 580+ → as little as 3.5% down

- 500–579 → may qualify with 10% down

- Insured by the Federal Housing Administration

Why FHA works:

It’s designed for buyers who may not have perfect credit but can afford the payment.

🏠 Conventional Loans

- 620+ minimum

- Backed by Fannie Mae and Freddie Mac

- Better interest rates as your score increases

Best pricing usually starts around:

- 740+

🌾 USDA Loans (Rural & Suburban Areas)

- Typically 640+

- 0% down

- Income and location limits apply

- Backed by the United States Department of Agriculture

What Credit Score Is “Comfortable” to Buy?

Here’s a simple way to think about it:

- 580–619 → You may qualify, but payments can be higher

- 620–679 → Solid approval range

- 680–739 → Better rates and more flexibility

- 740+ → Best rates and lowest payments

👉 Important:

Your credit score affects your interest rate and monthly payment, not just approval.

Credit Score Is Only Part of the Picture

This is where many buyers get confused.

Lenders don’t just look at your score — they also look at:

- Your monthly debts compared to income

- How recent late payments are

- How much money you have saved

- Your down payment options

- The type of loan you’re using

I’ve helped buyers qualify with:

- Mid-600 scores

- Past credit challenges

- Limited credit history

Because the overall financial picture made sense.

The Truth Most Buyers Don’t Hear

❌ You do NOT need an 800 credit score

❌ You do NOT need 20% down

❌ You do NOT need to “wait until everything is perfect”

✅ You need clarity, strategy, and real numbers

Sometimes you’re closer than you think — even if you’re not ready today.

Not Sure Where You Stand?

If you’re asking:

- “Can I buy now?”

- “How close am I?”

- “What credit score should I aim for?”

That’s exactly what I help buyers figure out every day.

Direct Line (562) 281-6163

Main Office (866) 587-6927

David Delgado – NMLS #349079

Presiden/CEO

Freedom Choice Lending

NMLS #1998153

Click Here To Schedule a 15 Loan Consultation Call

Fast Approvals call (562) 281-6163

No Money Down Payment Programs

Reverse Mortgages

FHA

Jumbo

Conventional Elite (Easy to qualify)

97% Conventional Financing

Bank Statements, P&L Only , No Income No Tax Returns

Shop Your Loan With Over 200 Loan Products From The TOP Wholesale Lenders In The Country!

On Time Closings Guaranteed or We Will Pay $1000 penalty fee!*

Need Professional Advisor ?

Need Professional Advisor ?

Leave a Reply