By David Delgado | Freedom Choice Lending

Buying your first home is exciting — and when you start exploring brand-new construction homes, the idea of being the first to live in it, pick your finishes, and enjoy modern design can sound like a dream come true.

But before you sign on the dotted line with a builder, it’s important to understand how new construction differs from buying a resale home — and what to watch out for to protect your investment.

Here’s what every first-time buyer should know 👇

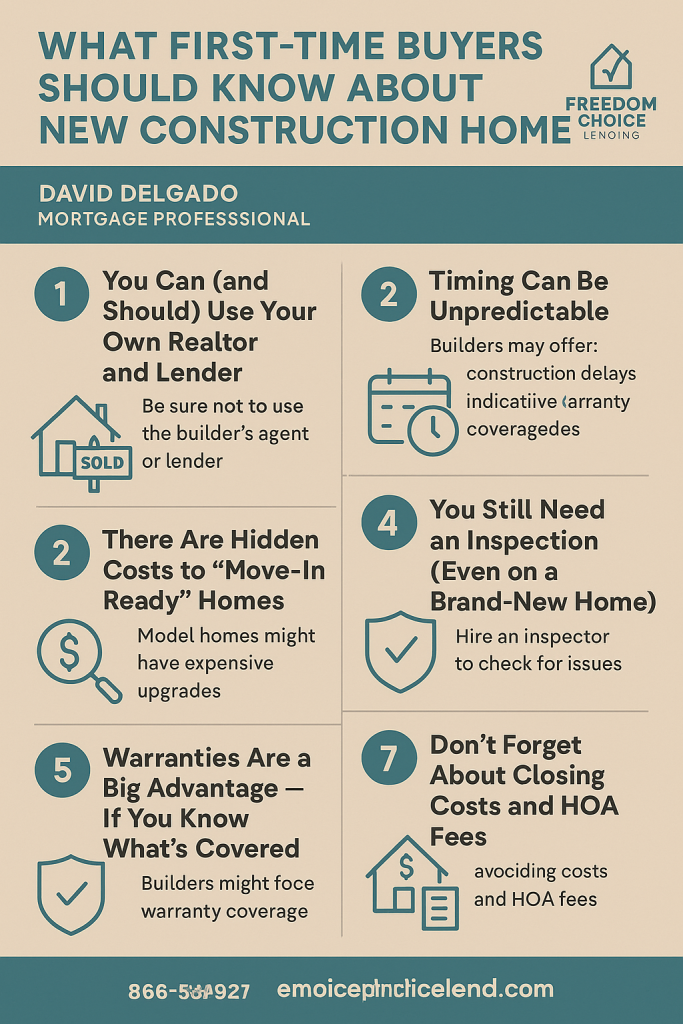

🔹 1. You Can (and Should) Use Your Own Realtor and Lender

Many buyers assume they have to use the builder’s sales agent and lender — but you always have a choice.

- Builder’s agent represents the builder, not you. Their goal is to sell homes at the best terms for the builder.

- Your agent protects your interests, negotiates upgrades, and helps you understand your contract.

- Your lender (like Freedom Choice Lending) helps you compare the builder’s incentives vs. market rates. Builders often offer “discounts,” but they may roll in higher fees or rates elsewhere.

Pro Tip: Bring your lender in early — before you visit the builder’s sales office. Some builders require prequalification from their preferred lender even if you choose to finance elsewhere.

🔹 2. There Are Hidden Costs to “Move-In Ready” Homes

That perfect model home you tour? It’s often packed with thousands of dollars in upgrades — flooring, countertops, lighting, landscaping, window coverings, and more.

Ask the builder:

✅ What’s included in the base price?

✅ What are the upgrade packages (and costs)?

✅ What comes standard with appliances, fixtures, and landscaping?

Sometimes the “standard” version can feel pretty bare bones — so make sure you know what you’re really getting.

🔹 3. Timing Can Be Unpredictable

Unlike existing homes, new construction timelines can shift due to supply chain delays, labor shortages, or city permit approvals.

Typical build times range from 6 to 12 months, but you’ll want flexibility in your plans.

If you’re renting, don’t set your move-out date too soon — delays are common.

Ask:

- “What’s the average completion time for this model?”

- “What happens if construction is delayed?”

- “Can I lock my interest rate long enough to cover possible delays?”

At Freedom Choice Lending, we offer extended rate locks designed for new builds — so you can protect your rate months before you move in.

🔹 4. You Still Need an Inspection (Even on a Brand-New Home)

Many buyers skip inspections on new homes, assuming “everything’s new, so it must be perfect.”

But even new builds can have construction defects or shortcuts — from plumbing leaks to insulation gaps to foundation issues.

Hire a licensed home inspector (not affiliated with the builder). Consider having:

- A pre-drywall inspection (before walls are closed up)

- A final inspection (before closing)

It’s your best protection before you take ownership.

🔹 5. Warranties Are a Big Advantage — If You Know What’s Covered

Most builders include:

- 1-year workmanship warranty (covers defects in materials)

- 2-year systems warranty (covers plumbing, electrical, HVAC)

- 10-year structural warranty (covers major foundation or framing issues)

Still, read the fine print — some warranties are backed by third parties with limitations. Keep detailed records and communicate promptly if issues arise.

🔹 6. Location Still Matters More Than “New”

A beautiful new home won’t help your long-term wealth if it’s in an area with limited appreciation potential.

Before you buy:

✅ Research the local job market

✅ Check school ratings and future development plans

✅ Review comparable resale values nearby

New homes are exciting, but location and equity growth are what truly build wealth over time.

🔹 7. Don’t Forget About Closing Costs and HOA Fees

Builders sometimes offer to cover a portion of your closing costs if you use their preferred lender — but always compare total costs.

Also, new communities often have HOA or special tax assessments (Mello-Roos in California) that can add hundreds to your monthly payment.

Before you sign:

💡 Ask for a breakdown of HOA dues and property taxes

💡 Have your lender estimate your total payment — not just principal and interest

🔹 Final Thoughts

Buying new construction can be an incredible opportunity — modern design, energy efficiency, and low maintenance are major benefits. But understanding the process protects you from surprises.

When you work with Freedom Choice Lending, we help you:

✅ Get pre-approved early for builder prequalification

✅ Compare builder vs. market rates

✅ Lock your interest rate during construction

✅ Budget for upgrades, taxes, and closing costs

🗝️ Ready to explore new construction homes?

Let’s walk through your options and see if it’s the right fit for your goals.

Direct Line (562) 281-6163

Main Office (866) 587-6927

David Delgado – NMLS #349079

Presiden/CEO

Freedom Choice Lending

NMLS #1998153

Click Here To Schedule a 15 Loan Consultation Call

Fast Approvals call (562) 281-6163

No Money Down Payment Programs

Reverse Mortgages

FHA

Jumbo

Conventional Elite (Easy to qualify)

97% Conventional Financing

Bank Statements, P&L Only , No Income No Tax Returns

Shop Your Loan With Over 200 Loan Products From The TOP Wholesale Lenders In The Country!

On Time Closings Guaranteed or We Will Pay $1000 penalty fee!*

**Be aware! Online banking fraud is on the rise. If you receive an email containing WIRE TRANSFER INSTRUCTIONS call your escrow officer immediately to verify the information prior to sending funds.**

Need Professional Advisor ?

Need Professional Advisor ?

Leave a Reply