By David Delgado | Freedom Choice Lending

🤔 The Big Question Every Buyer Is Asking

If you’ve been watching mortgage rates lately, you’re not alone. Every week, buyers ask me the same thing:

“David, should I wait until rates drop before I buy a home?”

It’s a fair question — especially when headlines keep saying “rates are high.” But here’s the truth most people don’t realize: waiting for the perfect rate often costs more than buying now.

Let’s break it down.

📉 Interest Rates vs. Home Prices: The Hidden Trade-Off

Yes, mortgage rates have risen from the record lows we saw a few years ago. But while everyone is waiting for rates to fall, home prices continue to climb.

According to California market data, home values have been appreciating between 4% to 6% per year — even with higher rates. That means a $700,000 home could cost over $735,000 next year, even if rates dip slightly.

If you wait, you could face:

- Higher purchase prices

- More buyer competition when rates drop

- Fewer homes available (lower inventory)

When rates eventually fall, thousands of sidelined buyers will rush back in — driving bidding wars all over again.

💡 The Smarter Strategy: “Marry the Home, Date the Rate”

Here’s what savvy buyers do:

They buy the home they love now — and refinance later when rates drop.

This approach locks in today’s price and lets you build equity while everyone else is still waiting.

Remember: you can always refinance a rate, but you can’t go back in time to buy a cheaper house.

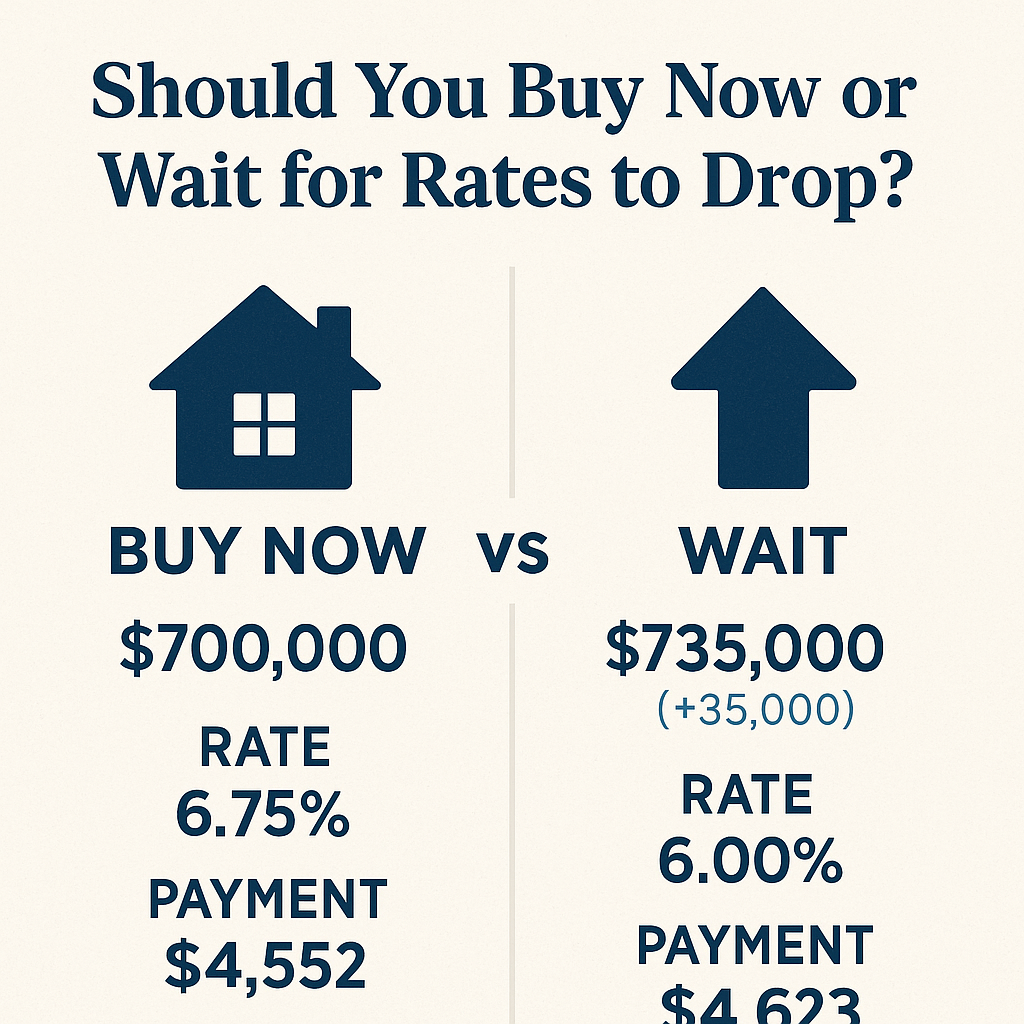

For example:

- Today’s rate: 6.75%

- Home price: $700,000

- Same home next year (with 5% appreciation): $735,000

Even if rates drop to 6.0%, your payment might be the same or higher due to the price increase.

💰 The Cost of Waiting: A Real Example

Let’s say you’re buying a $700,000 home with 5% down.

If home prices rise just 5% in one year, that same home costs $735,000 — an extra $35,000.

Meanwhile, waiting also means missing out on a full year of equity growth and tax benefits.

So instead of trying to time the market, the better move is to get in sooner and start gaining equity now.

🏠 Refinance Relief: Your Future Option

Most lenders, including Freedom Choice Lending, are already helping buyers with “refinance later” programs — some even cover your future refinance costs when rates drop.

This gives you peace of mind knowing you can buy with confidence today and save more tomorrow.

🌟 Why Buying Now Still Makes Sense

- Build Equity Sooner – Every payment helps you own more of your home.

- Avoid Rising Home Prices – Beat the wave of buyers who’ll return when rates fall.

- Enjoy Tax Benefits – Homeownership still offers strong tax deductions.

- Refinance Later – Take advantage of lower rates when they come.

🔑 Final Thoughts

Waiting for the “perfect rate” can feel safe — but in real estate, waiting often costs more than acting.

If you find a home you love and can afford the payment today, you’re already ahead of most buyers.

As a mortgage professional at Freedom Choice Lending, I’ve helped hundreds of buyers lock in smart financing strategies that balance affordability now with flexibility later.

Let’s talk about your goals — and run the numbers to see if waiting really benefits you.

Direct Line (562) 281-6163

Main Office (866) 587-6927

David Delgado – NMLS #349079

Presiden/CEO

Freedom Choice Lending

NMLS #1998153

Click Here To Schedule a 15 Loan Consultation Call

Fast Approvals call (562) 281-6163

No Money Down Payment Programs

Reverse Mortgages

FHA

Jumbo

Conventional Elite (Easy to qualify)

97% Conventional Financing

Bank Statements, P&L Only , No Income No Tax Returns

Shop Your Loan With Over 200 Loan Products From The TOP Wholesale Lenders In The Country!

On Time Closings Guaranteed or We Will Pay $1000 penalty fee!*

**Be aware! Online banking fraud is on the rise. If you receive an email containing WIRE TRANSFER INSTRUCTIONS call your escrow officer immediately to verify the information prior to sending funds.**

Need Professional Advisor ?

Need Professional Advisor ?

Leave a Reply