As a mortgage professional with Freedom Choice Lending, one of the most common questions I hear from homeowners is:

“Should I pay off my mortgage early?”

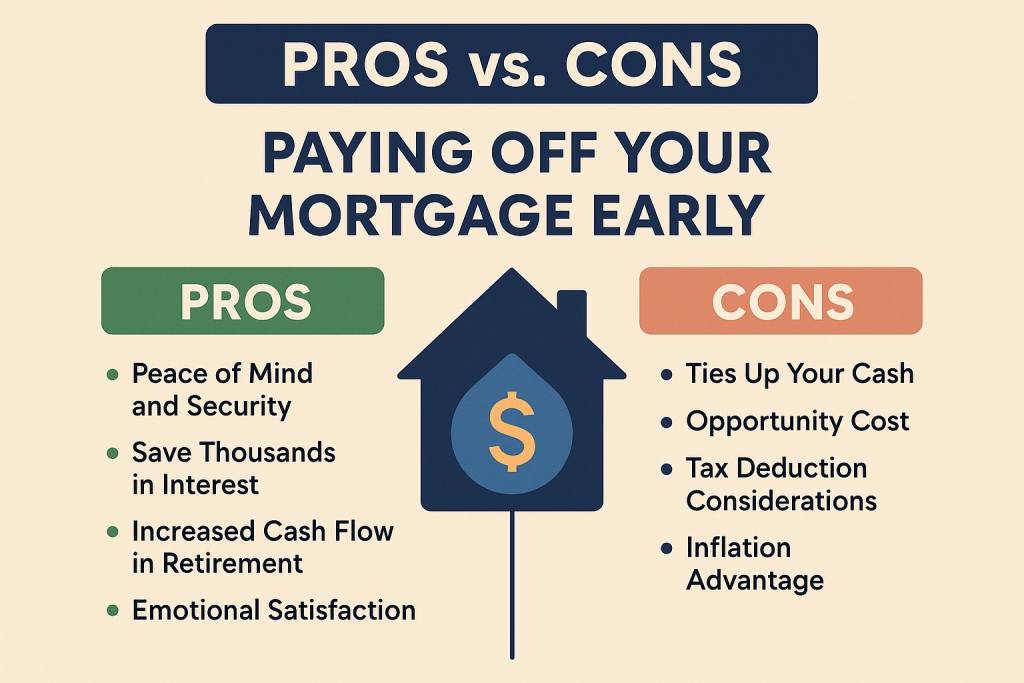

It’s an important decision—one that can impact your financial security, long-term wealth, and even your peace of mind. While the idea of being completely debt-free is appealing, the choice isn’t always as straightforward as it seems. Let’s break down the pros and cons so you can make the smartest decision for your family.

✅ The Pros of Paying Off Your Mortgage Early

1. Peace of Mind and Security

There’s a certain freedom in knowing your home is 100% yours. No matter what happens in the economy or job market, you won’t have to worry about making a monthly mortgage payment.

2. Save Thousands in Interest

Mortgages are long-term loans, often spanning 30 years. Paying off early can save you tens of thousands in interest over time. For example, even an extra $200 a month toward principal can shave years off your loan.

3. Increased Cash Flow in Retirement

Imagine heading into retirement without a mortgage payment. That extra $2,000–$3,000 each month can give you more breathing room for travel, healthcare, or simply enjoying life.

4. Emotional Satisfaction

Owning your home outright brings a deep sense of accomplishment. It’s a milestone worth celebrating and can be a powerful legacy for your family.

⚠️ The Cons of Paying Off Your Mortgage Early

1. Ties Up Your Cash

Once you put money into your home, it’s no longer liquid. If you need cash for emergencies, education, or investments, you’ll have to refinance or take out a line of credit.

2. Opportunity Cost

Mortgage rates are often lower than the returns you could potentially earn through investments. For instance, if your mortgage rate is 6% but you could earn 8%+ investing in the stock market or real estate, you might grow wealth faster by investing instead of paying off early.

3. Tax Deduction Considerations

While not as significant after recent tax law changes, some homeowners still benefit from the mortgage interest deduction. Paying off early could reduce those tax benefits.

4. Inflation Advantage

Over time, inflation makes your fixed mortgage payment “cheaper” in today’s dollars. Paying off early eliminates this benefit.

Balanced Approach: The Middle Ground

For many buyers, the best strategy is a hybrid approach:

- Make your regular mortgage payment.

- Add extra principal payments when possible.

- Still invest in retirement accounts, college funds, or other opportunities that can grow your wealth.

This way, you shorten your loan term and build equity faster—while keeping your financial flexibility intact.

My Advice as Your Mortgage Professional

At Freedom Choice Lending, I always tell clients: Your mortgage is more than just a debt—it’s also a tool. The key is making it work for your long-term goals.

If paying off your mortgage early gives you peace of mind and aligns with your retirement plans, it can be a smart move. If maximizing your investments and liquidity is your top priority, keeping the mortgage and investing extra funds might serve you better.

Every family’s situation is unique, and that’s why I offer personalized mortgage planning consultations. Together, we’ll review your goals, run the numbers, and find the path that helps you build the life you want.

Final Thoughts

Paying off your mortgage early isn’t just about math—it’s about strategy, lifestyle, and peace of mind. Before making the decision, consider your financial goals, risk tolerance, and long-term dreams.

👉 Thinking about your mortgage payoff strategy? Reach out today—I’d be happy to walk you through your options and help you design the plan that’s right for you.

Direct Line (562) 281-6163

Main Office (866) 587-6927

David Delgado – NMLS #349079

Presiden/CEO

Freedom Choice Lending

NMLS #1998153

Click Here To Schedule a 15 Loan Consultation Call

Fast Approvals call (562) 281-6163

No Money Down Payment Programs

Reverse Mortgages

FHA

Jumbo

Conventional Elite (Easy to qualify)

97% Conventional Financing

Bank Statements, P&L Only , No Income No Tax Returns

Shop Your Loan With Over 200 Loan Products From The TOP Wholesale Lenders In The Country!

On Time Closings Guaranteed or We Will Pay $1000 penalty fee!*

**Be aware! Online banking fraud is on the rise. If you receive an email containing WIRE TRANSFER INSTRUCTIONS call your escrow officer immediately to verify the information prior to sending funds.**

Need Professional Advisor ?

Need Professional Advisor ?

Leave a Reply