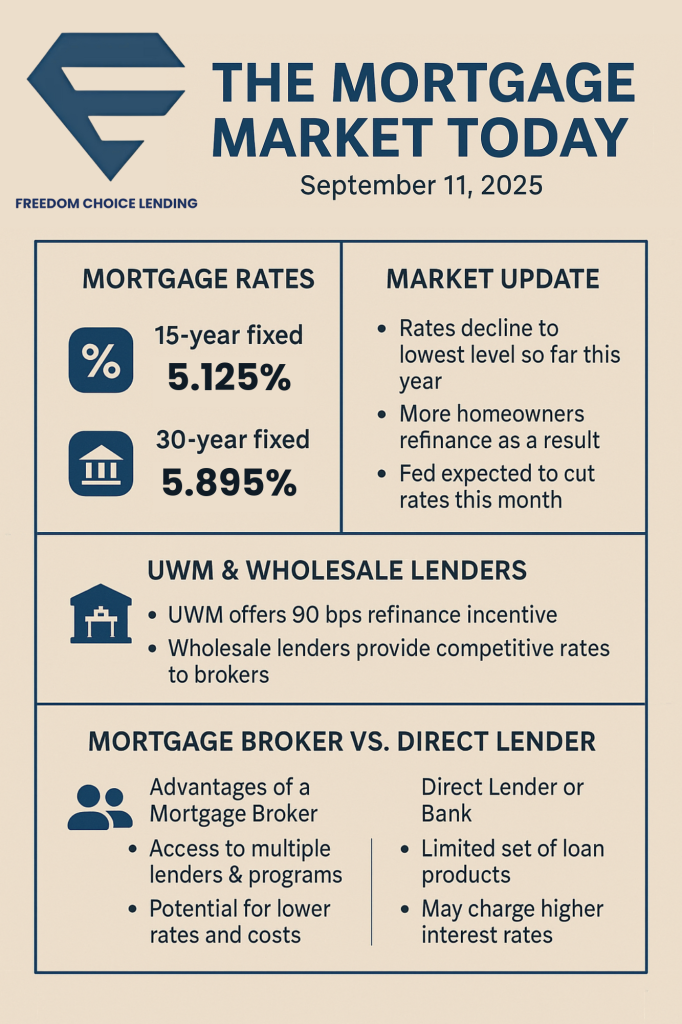

Recent data indicates mortgage rates have dropped modestly, offering a little relief for both buyers and homeowners who might refinance. Key figures:

- 30-year fixed mortgages are averaging about 5.895%, down from week prior, reaching the lowest in nearly a year.

- 15-year fixed rates are in the vicinity of 5.125%, with some variation depending on source and credit quality.

These declines appear to be driven by softer job market data, lower yields on 10-year Treasuries, and increasing confidence that the Federal Reserve may begin cutting short-term rates.

Freedom Choice Lending Shops loans with the top 200 wholesale lenders. Here’s rates as of September 11 2025 9:41 AM PST

Rates based on 80% LTV Refinance $648,000 Loan Amount 740 Fico score. APR 6.051%

Activity

- Mortgage application volume is picking up: both purchase and refinance applications rose.

- Refinance demand especially strong: many homeowners with older loans above the current average are seeing opportunity.

- Affordability concerns persist, particularly in expensive markets. Even with rate drops, high prices of homes and tight housing inventory are still major hurdles.

Fed Outlook

- A 25 basis point cut in the federal funds rate is widely expected at the Fed meeting scheduled around mid-September. Many analysts believe there could be more cuts before the end of the year. Reuters

- The effect of Fed rate cuts on long-term mortgage rates tends to lag, since rates are more directly influenced by bond markets, inflation expectations, Treasury yields, etc.

UWM & Wholesale Lender Highlights

United Wholesale Mortgage (UWM) remains a key player in the wholesale channel. Recent moves:

- In Q2 2025, UWM reported $39.7 billion in loan origination volume (up ~18% year-over-year), with strong operational performance. United Wholesale Mortgage

- UWM is offering a 90 basis point refinance incentive through mid-September 2025. That’s designed to encourage refinances (rate-and-term) under favorable conditions. AInvest

- UWM is also pursuing strategic debt refinancing to improve its long-term funding costs, extend maturities, and enhance profitability. This kind of capital structure management can strengthen its ability to offer competitive pricing through brokers.

Because UWM operates in the wholesale channel (i.e. it lends to mortgage brokers rather than directly to retail borrowers), its offers, incentives, and cost structure tend to matter more for brokers, which in turn may affect what consumers see.

What Homeowners & Buyers Can Use

If you’re a homeowner or potential buyer, here are some take-aways:

- If you have a mortgage with a rate significantly above ~6.5%, a refinance could save you hundreds monthly (depending on your loan size and remaining term).

- Buying power shifts a bit when rates drop: lower rates mean lower payments for the same loan principal, which might let some buyers stretch a bit more — or qualify for a bit more. But price levels and down payments still matter a lot.

- Keep an eye on local market conditions: even when national averages drift down, some regions may still have high competition, limited inventory, or other cost pressures (taxes, insurance, local rules).

- If you’re considering locking a rate, don’t assume deeper cuts are guaranteed beyond what’s already priced in. Economist forecasts tend to be cautious.

Broker vs. Direct Lender / Bank: Advantages & Trade-Offs

One of the big decisions when shopping mortgages is who does your loan. Here’s how a broker (often using wholesale lenders like UWM) stacks up against going direct with a bank or direct lender.

| Aspect | Mortgage Broker / Wholesale Channel (e.g. working with brokers sourcing from providers like UWM) | Direct Lender / Bank / Retail Lender |

|---|---|---|

| Choice of Products & Competition | Brokers can shop your loan among many wholesale lenders. They may find more competitive rates, more variety (different programs, terms). | Direct lenders are “one stop”: you get what they offer. Less variety, but possibly more consistency. |

| Pricing / Rate Offers | Because wholesale lenders often have lower overhead on the lending side, the rates or incentives (e.g. UWM’s refinance offers) may be more aggressive. Brokers may also have access to special pricing. | Banks may offer deals, but often higher overhead is baked into cost; their pricing can be less flexible. |

| Personalization / Guidance | Good mortgage brokers tend to provide more hands-on guidance, helping you compare options, navigating the paperwork, and sometimes working with multiple lenders behind the scenes. | Direct lenders may handle everything in-house; may be more streamlined, but less comparative context from you. |

| Speed / Communication | Brokers juggle multiple lenders which means more options, but sometimes managing the process can take more coordination. The flip-side: a broker who knows their lenders well can speed things up. | Direct lenders control the full pipeline; might have faster internal processes but potentially less incentive to find you the absolute best rate. |

| Transparency & Fees | With brokers, its about transparency: how they get paid (commission, yield spread, service fees) are fully disclosed with a Loan Estimate. | Banks / direct lenders are more constrained; their fee structure is often more standardized. There fee’s are paid through the interest rate and the yield spread premium YSP compensation is not disclosure |

What to Watch Going Forward

- Fed policy announcements (especially the September meeting) will be important; markets are expecting a cut, but how much and when will influence mortgage rates down the road.

- Movements in 10-year Treasury yields – since long-term mortgage rates tend to follow them. If economic data weakens, yields may drop, pushing mortgage rates lower. If inflation or growth surprises upward, the reverse could happen.

- Housing supply & inventory, especially of affordably priced homes, will continue to influence price trends. If supply loosens, that helps buyers. If prices keep rising or homes are scarce, affordability remains a major challenge.

- Local/regional differences: some markets may see stronger demand, others more slack. Also pay attention to credit score benchmarks, loan program availability (FHA, VA, conforming vs jumbo), down payment trends.

Bottom Line

- Rates are easing, but we’re not back to the very low levels of a few years ago. For many buyers/refinancers, the current 30-year fixed (~6.5%) or 15-year fixed (~5.6%) is better than what’s been seen lately.

- If you have a higher-rate loan, refinance could be worth exploring. But factor in closing costs, remaining time on loan, future plans (how long you’ll stay in the home).

- If you’re shopping for a mortgage, using a broker (especially one who works with wholesale lenders like UWM) is likely to offer broader options and possibly better pricing—just make sure to ask questions about fees and lender reliability.

- And keep expectations realistic: rate cuts may come, but they won’t instantly make things easy everywhere. Affordability pressures (home prices, other costs) are still very real.

Direct Line (562) 281-6163

Main Office (866) 587-6927

David Delgado – NMLS #349079

Presiden/CEO

Freedom Choice Lending

NMLS #1998153

Click Here To Schedule a 15 Loan Consultation Call

Fast Approvals call (562) 281-6163

No Money Down Payment Programs

Reverse Mortgages

FHA

Jumbo

Conventional Elite (Easy to qualify)

97% Conventional Financing

Bank Statements, P&L Only , No Income No Tax Returns

Shop Your Loan With Over 200 Loan Products From The TOP Wholesale Lenders In The Country!

On Time Closings Guaranteed or We Will Pay $1000 penalty fee!*

**Be aware! Online banking fraud is on the rise. If you receive an email containing WIRE TRANSFER INSTRUCTIONS call your escrow officer immediately to verify the information prior to sending funds.**

Need Professional Advisor ?

Need Professional Advisor ?

Leave a Reply