By David Delgado | Freedom Choice Lending

If you’ve owned your home for a few years, you might be sitting on one of the best opportunities to lower your monthly payments, build equity faster, or even eliminate years off your loan—simply by refinancing your mortgage.

At Freedom Choice Lending, we help homeowners understand how refinancing works and when it actually makes sense. Here’s what you need to know before you take that next step.

💡 What Is Mortgage Refinancing?

Refinancing means replacing your current mortgage with a new one—usually to get a better rate, different term, or cash out equity.

Think of it as upgrading your loan to match your current financial goals.

When you refinance, your new lender pays off the old mortgage, and you start fresh under new terms that better fit your needs.

💰 Top Reasons Homeowners Refinance

Here are the most common goals we see at Freedom Choice Lending:

- Lower Your Interest Rate:

If today’s rates are lower than what you originally locked in, refinancing could help you save hundreds of dollars a month and thousands over the life of your loan. - Reduce Your Loan Term:

Switching from a 30-year to a 15-year mortgage can help you pay off your home faster and save tens of thousands in interest—perfect for those focused on long-term wealth. - Cash-Out Refinance:

Use your home’s equity to consolidate high-interest debt, fund home improvements, or invest in new opportunities—all while possibly keeping your payments manageable. - Remove Mortgage Insurance (PMI):

If your home has appreciated and you now have 20% or more in equity, refinancing can remove PMI and instantly lower your payment. - Switch Loan Types:

Many homeowners move from an FHA loan to a conventional loan once their equity increases, or from an ARM to a fixed rate for more stability.

📉 When Does Refinancing Make Sense?

A good rule of thumb:

👉 If you can lower your rate by at least 0.5% to 1%, refinancing is worth exploring.

Other ideal times to refinance:

- You’ve improved your credit score since your original loan.

- Your home value has significantly increased.

- You plan to stay in the home long enough to recoup closing costs.

💭 Pro Tip: Calculate your “break-even point.”

That’s how long it takes for your monthly savings to cover the cost of refinancing. If you plan to stay beyond that, it’s likely a smart move.

🧾 What You’ll Need to Refinance

The process is similar to your original loan, but usually much smoother:

- Income verification (recent pay stubs, W-2s, or tax returns)

- Credit check to confirm your current score

- Home appraisal to verify your property’s market value

- Current mortgage statement for payoff details

Once we have these, our team compares multiple wholesale lenders to find your best rate and lowest cost options.

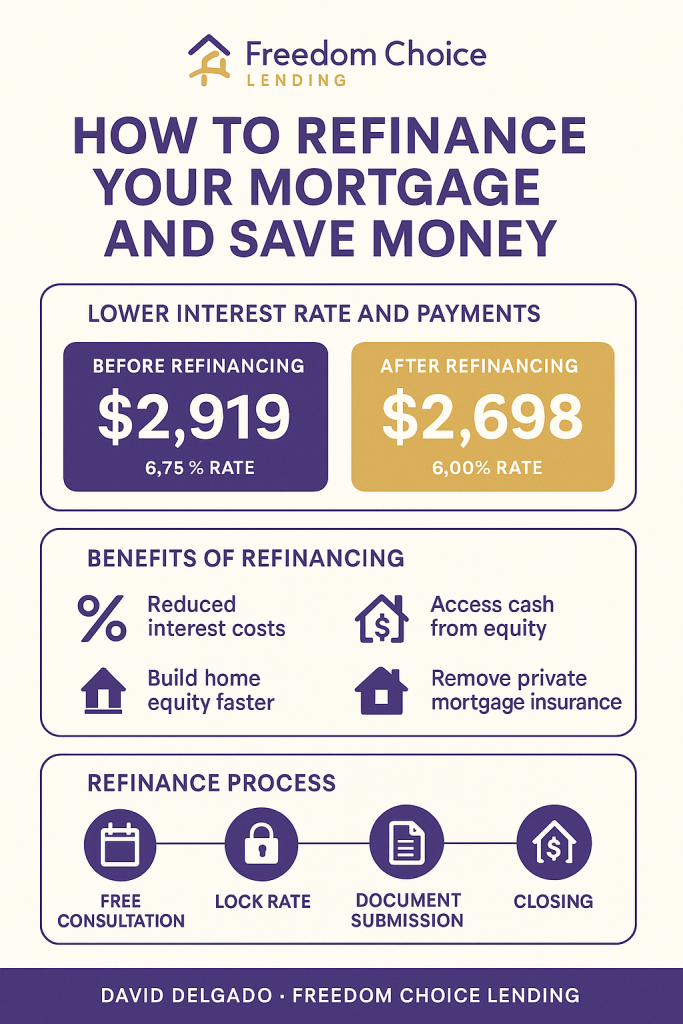

🧮 Example: How Refinancing Saves You Money

Let’s say you currently owe $450,000 at 6.75% on a 30-year loan.

Your monthly payment (principal and interest) is about $2,919.

If you refinance to 6.00%, your payment drops to $2,698 — that’s $221 saved every month or over $79,000 in total interest over the life of the loan.

Now imagine applying some of that savings toward extra principal — you could shave off years of payments!

🕒 The Refinance Process (Step-by-Step)

- Schedule a Free Consultation – We’ll run the numbers to see if refinancing makes sense for you.

- Lock Your New Rate – Once you’re ready, we’ll secure the best available rate.

- Submit Documents – You’ll provide pay stubs, tax returns, and home details.

- Appraisal & Underwriting – Your home value and financials are reviewed.

- Closing Day – Sign your new loan docs and start saving.

From start to finish, most refinances take about 2–4 weeks depending on appraisal timelines.

🧠 Refinancing Myths (Debunked)

❌ “Refinancing always costs too much.”

✅ Not necessarily — many homeowners recover costs within months thanks to lower payments.

❌ “I’ll have to start my 30-year loan all over again.”

✅ You can choose a shorter term or custom term (like 23 or 25 years) to match your current schedule.

❌ “I don’t have enough equity.”

✅ Programs exist for low-equity or even VA/streamline refinances that don’t require a full appraisal.

🔑 The Bottom Line

Refinancing isn’t just about lowering your rate—it’s about aligning your mortgage with your financial goals. Whether that’s saving money, eliminating PMI, or leveraging equity, a refinance can help you make your home work smarter for you.

At Freedom Choice Lending, we’ll review your loan, calculate your savings, and design a strategy that helps you move closer to financial freedom.

📞 Ready to See How Much You Can Save?

Get a free refinance review today with Freedom Choice Lending.

We’ll show you your new estimated payment, break-even timeline, and long-term savings projection—no obligation.

Direct Line (562) 281-6163

Main Office (866) 587-6927

David Delgado – NMLS #349079

Presiden/CEO

Freedom Choice Lending

NMLS #1998153

Click Here To Schedule a 15 Loan Consultation Call

Fast Approvals call (562) 281-6163

No Money Down Payment Programs

Reverse Mortgages

FHA

Jumbo

Conventional Elite (Easy to qualify)

97% Conventional Financing

Bank Statements, P&L Only , No Income No Tax Returns

Shop Your Loan With Over 200 Loan Products From The TOP Wholesale Lenders In The Country!

On Time Closings Guaranteed or We Will Pay $1000 penalty fee!*

**Be aware! Online banking fraud is on the rise. If you receive an email containing WIRE TRANSFER INSTRUCTIONS call your escrow officer immediately to verify the information prior to sending funds.**

Need Professional Advisor ?

Need Professional Advisor ?

Leave a Reply