By David Delgado, Freedom Choice Lending

When it comes to understanding California’s housing market, most buyers focus on interest rates and home inventory. But there’s another powerful factor that often flies under the radar — local job growth.

If you’ve ever wondered why home prices in some California cities climb faster than others, the answer might lie in their employment numbers.

💼 Job Growth = Housing Demand

Simply put: where jobs go, people follow.

When a region experiences strong job creation — whether it’s new tech campuses in Irvine, logistics centers in Ontario, or healthcare expansions in Riverside — more workers move in, and that drives up demand for housing.

Even a moderate increase in employment can shift the balance between supply and demand, creating upward pressure on home prices.

📈 Example:

In areas like the Inland Empire, the rise of warehouse and logistics jobs has fueled a housing boom.

Similarly, Silicon Valley’s continued tech hiring keeps home prices among the highest in the nation — even during slowdowns.

🏗️ How Employment Growth Affects Your Buying Power

When more people have jobs and higher incomes:

- More buyers compete for fewer homes.

This competition can push prices above list value. - Rent prices also rise.

Which often motivates renters to finally buy. - Local economies strengthen.

Businesses expand, infrastructure improves, and that adds long-term value to nearby neighborhoods.

As a result, homeownership becomes not just a place to live — but an investment that grows alongside the local job market.

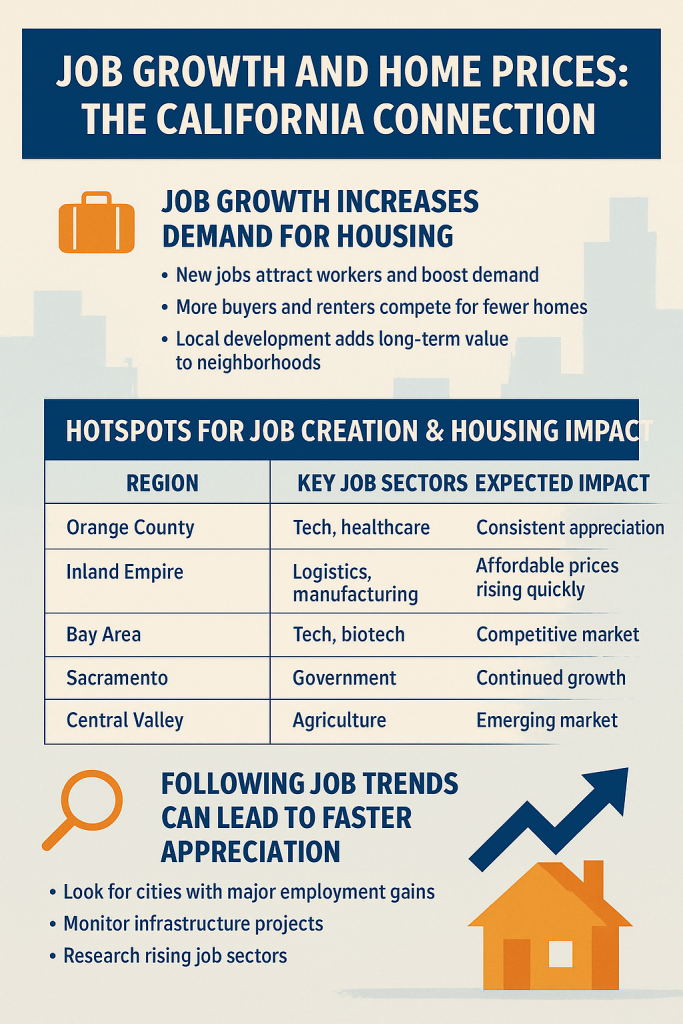

🏙️ The California Hotspots to Watch

Some cities are leading the way in job creation — and that momentum could impact their housing markets for years to come:

| Region | Key Job Sectors | Expected Impact on Housing |

|---|---|---|

| Orange County | Tech, healthcare, tourism | Consistent appreciation due to steady professional demand |

| Inland Empire (Riverside/San Bernardino) | Logistics, manufacturing | Affordable prices rising quickly as population surges |

| Bay Area | Tech, finance, biotech | Still one of the most competitive housing markets in the U.S. |

| Sacramento | Government, healthcare | Continued growth from Bay Area relocations |

| Central Valley | Agriculture, logistics | Emerging market as affordability pushes buyers inland |

🧭 What This Means for First-Time Buyers

If you’re looking to buy your first home in California, timing and location matter.

Buying in a city with rising job opportunities often means your property could appreciate faster than in slower-growth areas.

On the other hand, waiting until job growth pushes prices up could cost you tens of thousands over time.

Here’s how to use job trends to your advantage:

- Follow major employers. Look for cities adding hospitals, tech hubs, or logistics centers.

- Check local infrastructure projects. New freeways, schools, or transit expansions usually mean job growth is coming.

- Talk to a local mortgage professional (like us at Freedom Choice Lending). We can help you align your home search with local economic momentum.

💡 Pro Tip from David Delgado

“The best time to buy isn’t just when rates are low — it’s when the city you’re buying in is growing.

Jobs drive demand, and demand drives value.”

At Freedom Choice Lending, we help you analyze both market data and local trends, so you can buy in areas with strong appreciation potential — not just affordability.

✅ Final Thought

Home prices aren’t just about real estate — they’re about people, paychecks, and progress.

As California continues to evolve, the areas where jobs are thriving will likely see the strongest housing appreciation.

Stay ahead of the trend.

Buy where growth is happening — and let your home’s value rise with the local economy.

Direct Line (562) 281-6163

Main Office (866) 587-6927

David Delgado – NMLS #349079

Presiden/CEO

Freedom Choice Lending

NMLS #1998153

Click Here To Schedule a 15 Loan Consultation Call

Fast Approvals call (562) 281-6163

No Money Down Payment Programs

Reverse Mortgages

FHA

Jumbo

Conventional Elite (Easy to qualify)

97% Conventional Financing

Bank Statements, P&L Only , No Income No Tax Returns

Shop Your Loan With Over 200 Loan Products From The TOP Wholesale Lenders In The Country!

On Time Closings Guaranteed or We Will Pay $1000 penalty fee!*

**Be aware! Online banking fraud is on the rise. If you receive an email containing WIRE TRANSFER INSTRUCTIONS call your escrow officer immediately to verify the information prior to sending funds.**

Need Professional Advisor ?

Need Professional Advisor ?

Leave a Reply