As a mortgage professional here in California, one of the most common questions I hear is:

“Is now really a good time to buy a home?”

With interest rates, home prices, and the economy all making headlines, it’s natural to wonder if buying a home today is the right move. Let’s break it down so you can make an informed decision with confidence.

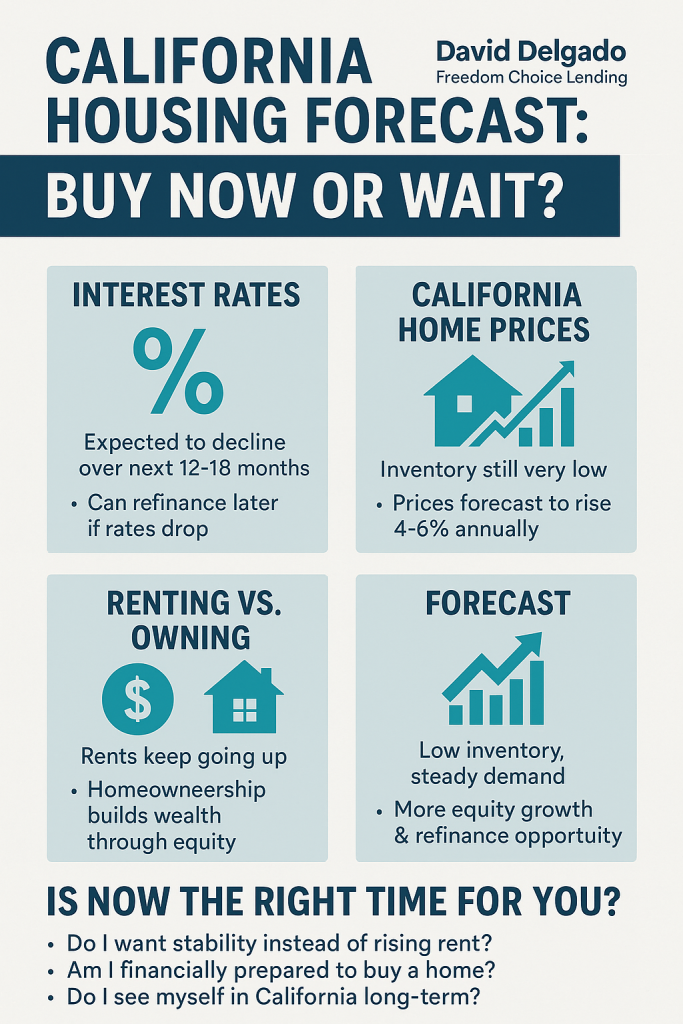

1. Interest Rates: Where Are We Headed?

Over the past couple of years, interest rates have risen sharply compared to the historically low levels we saw during the pandemic. But here’s the good news:

- Many experts forecast rates will gradually decline over the next 12–18 months.

- Buying now allows you to “marry the house, date the rate.” In other words, you can secure the home you love today and refinance later if rates drop.

Waiting for the “perfect” rate often costs buyers more in home appreciation than they could ever save in interest.

2. California Home Prices: Still Climbing

California has always had one of the most competitive real estate markets in the country. Even with higher interest rates, demand continues to outpace supply.

- Inventory remains historically low.

- Many areas of California are still seeing steady appreciation of 4–6% annually.

What does this mean for buyers? The longer you wait, the more expensive that dream home becomes.

3. Renting vs. Owning: The Wealth Gap

Renters across California are feeling the squeeze. Rents have increased dramatically, especially in metro areas like Los Angeles, Orange County, and the Bay Area.

- Rent payments build your landlord’s wealth—not yours.

- A mortgage builds equity, which is your stepping stone to long-term financial freedom.

Owning a home in California isn’t just about having a place to live—it’s one of the fastest ways to grow wealth in our state.

4. Forecast: What Experts Are Saying

Most housing experts project:

- Continued low housing inventory.

- Steady price growth fueled by demand.

- Slightly lower interest rates over the next few years.

Translation: If you buy now, you’re positioned to benefit from both equity growth and future refinancing opportunities.

5. Is Now the Right Time for You?

The best time to buy isn’t based on the market alone—it’s based on your personal goals. Ask yourself:

- Do I want stability instead of rising rent?

- Am I financially prepared for a down payment and monthly mortgage?

- Do I see myself in California long-term?

If the answer is “yes” to these, then waiting might cost you more than acting now.

Final Thoughts from David Delgado

At Freedom Choice Lending, I believe the best time to buy is when you are ready—but the forecast shows that buyers who act now in California are setting themselves up for strong financial gains.

Your home is more than just a roof over your head—it’s your key to building wealth, stability, and a brighter future.

👉 If you’d like to see what buying looks like for you in today’s market, let’s schedule a free consultation. I’ll walk you through custom loan scenarios, rent-vs-buy comparisons, and strategies to secure your homeownership dream.

Direct Line (562) 281-6163

Main Office (866) 587-6927

David Delgado – NMLS #349079

Presiden/CEO

Freedom Choice Lending

NMLS #1998153

Click Here To Schedule a 15 Loan Consultation Call

Fast Approvals call (562) 281-6163

No Money Down Payment Programs

Reverse Mortgages

FHA

Jumbo

Conventional Elite (Easy to qualify)

97% Conventional Financing

Bank Statements, P&L Only , No Income No Tax Returns

Shop Your Loan With Over 200 Loan Products From The TOP Wholesale Lenders In The Country!

On Time Closings Guaranteed or We Will Pay $1000 penalty fee!*

**Be aware! Online banking fraud is on the rise. If you receive an email containing WIRE TRANSFER INSTRUCTIONS call your escrow officer immediately to verify the information prior to sending funds.**

Need Professional Advisor ?

Need Professional Advisor ?

Leave a Reply