By David Delgado – Mortgage Professional, Freedom Choice Lending

When most people think about wealth, they think about stocks, retirement accounts, or even starting a business. While those are great, there’s one wealth-building tool that millions of families have used for generations—and it’s right where you live: homeownership.

For first-time buyers, understanding how equity works can be the difference between staying stuck in the cycle of renting or putting yourself on the fast track to financial freedom.

What Is Home Equity?

Equity is simply the difference between your home’s market value and the amount you still owe on your mortgage. As your home value goes up and your loan balance goes down, your equity grows.

Think of it like a savings account you live in. Every mortgage payment isn’t just paying off debt—it’s putting money back into your pocket through equity.

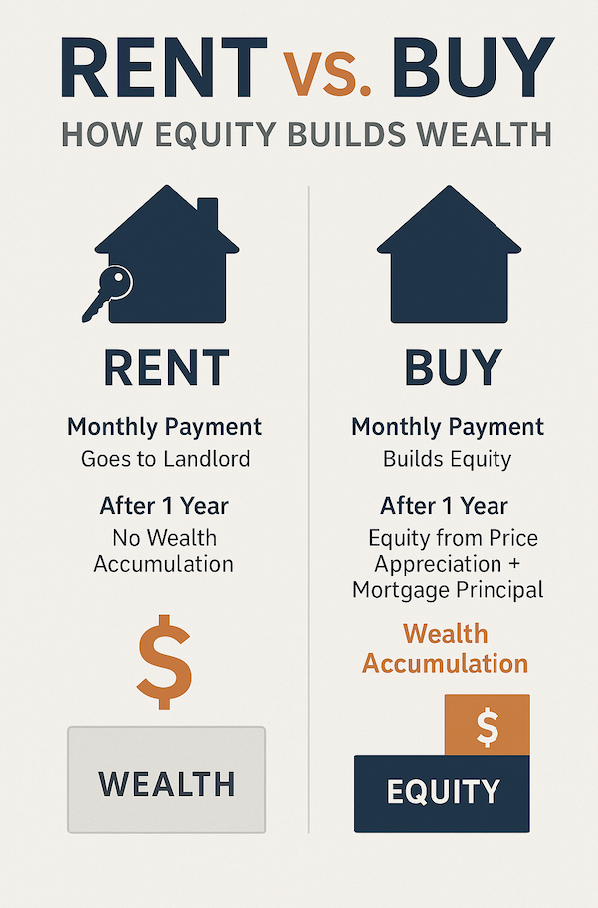

Why Buying Beats Renting

When you rent, your monthly payment goes into your landlord’s pocket. When you buy, your monthly payment works for you in three powerful ways:

- Principal Reduction: Each payment chips away at your loan balance, increasing your ownership stake.

- Appreciation: Real estate historically appreciates over time. In many California markets, home values rise 4–6% per year on average.

- Leverage: With as little as 3–5% down, you control 100% of the home’s value. That means even a small increase in value can create huge gains in your net worth.

For example, let’s say you buy a $600,000 home with 5% down. If your home appreciates 5% in one year, that’s a $30,000 gain. Compare that to renting—where after 12 months, all you have is receipts.

Equity = Wealth You Can Use

Equity isn’t just numbers on paper. It’s usable wealth. Homeowners often use their equity to:

- Fund renovations to increase property value

- Consolidate high-interest debt into a low-rate mortgage

- Cover college tuition or invest in another property

- Create a safety net for unexpected life events

The key is this: every month you pay your mortgage, you’re creating options for your financial future.

Generational Wealth and Stability

Owning a home doesn’t just benefit you today—it creates a foundation for your family tomorrow. Studies consistently show that homeowners have significantly higher net worths than renters. In fact, according to the Federal Reserve, the average homeowner’s net worth is nearly 40 times greater than that of the average renter.

That’s why buying a home isn’t just about shelter—it’s about security, stability, and passing wealth down to future generations.

Take the First Step

Many first-time buyers hesitate because they think they need perfect credit, a 20% down payment, or years of preparation. The truth is, there are loan programs designed to make homeownership accessible sooner than you think.

At Freedom Choice Lending, my team and I help renters become homeowners every day. We’ll walk you through your financing options, show you how much home you can afford, and help you create a plan to start building equity right away.

Final Thought

Renting keeps you on the sidelines. Buying puts you in the game—and every month, you’re scoring points toward your financial future.

The fastest path to wealth isn’t waiting for the perfect moment—it’s taking action today.

👉 Ready to explore your path to homeownership? Let’s schedule a free consultation and see how quickly you can start building equity.

Direct Line (562) 281-6163

Main Office (866) 587-6927

David Delgado – NMLS #349079

Presiden/CEO

Freedom Choice Lending

NMLS #1998153

Click Here To Schedule a 15 Loan Consultation Call

Fast Approvals call (562) 281-6163

No Money Down Payment Programs

Reverse Mortgages

FHA

Jumbo

Conventional Elite (Easy to qualify)

97% Conventional Financing

Bank Statements, P&L Only , No Income No Tax Returns

Shop Your Loan With Over 200 Loan Products From The TOP Wholesale Lenders In The Country!

On Time Closings Guaranteed or We Will Pay $1000 penalty fee!*

**Be aware! Online banking fraud is on the rise. If you receive an email containing WIRE TRANSFER INSTRUCTIONS call your escrow officer immediately to verify the information prior to sending funds.**

Need Professional Advisor ?

Need Professional Advisor ?

Leave a Reply