As a first-time homebuyer, you may hear real estate professionals talk about home appreciation. But what does that really mean—and why should you care? At Freedom Choice Lending, I believe knowledge is power, and understanding appreciation is one of the keys to building long-term wealth through homeownership.

What Is Home Appreciation?

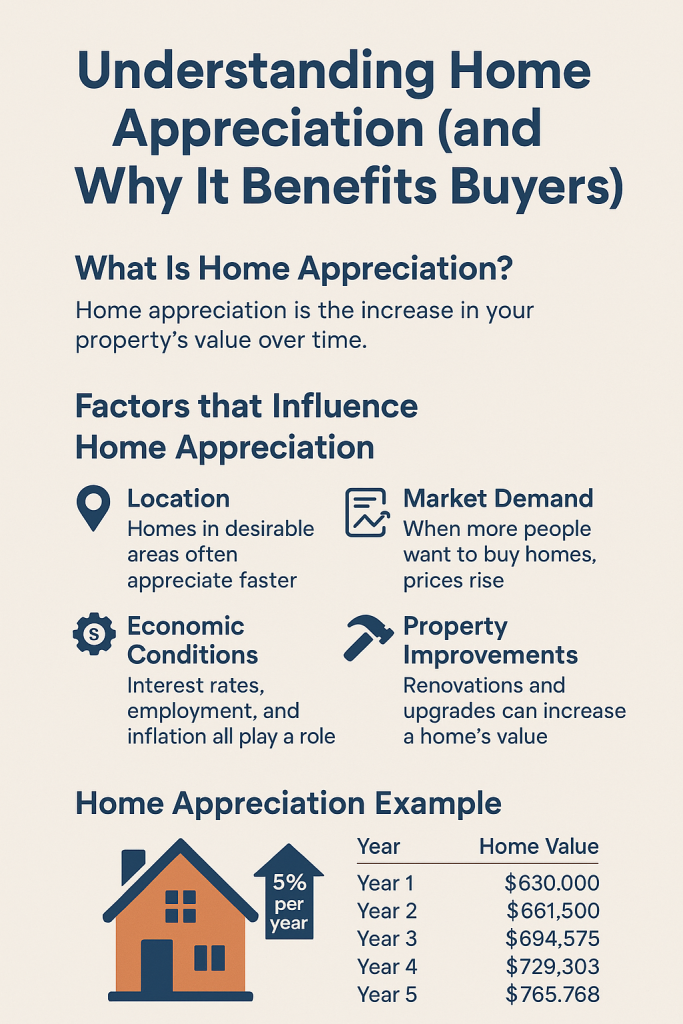

Home appreciation is the increase in your property’s value over time. Several factors influence appreciation, including:

- Location – Homes in desirable neighborhoods, near good schools, or close to job centers often appreciate faster.

- Market Demand – When more people want to buy homes than there are homes available, prices rise.

- Economic Conditions – Interest rates, employment, and inflation can all impact housing prices.

- Property Improvements – Renovations and upgrades (like a kitchen remodel or energy-efficient windows) can directly increase a home’s value.

In simple terms: if you buy a home today for $500,000 and it’s worth $550,000 in a few years, your home has appreciated by $50,000.

Why Home Appreciation Benefits Buyers

1. Builds Equity

Every dollar your home gains in value increases your equity—your ownership stake in the property. This equity can be tapped later for home improvements, paying off debt, or investing in additional properties.

2. Outpaces Rent

Renters face rising rental costs year after year with no ownership benefits. Homeowners, however, can lock in a stable monthly payment with a fixed-rate mortgage while their property value (and wealth) continues to grow.

3. Protects Against Inflation

As the cost of living rises, so does the value of real estate. Owning a home gives you a hedge against inflation because your asset appreciates while your fixed mortgage payment stays the same.

4. Creates Long-Term Wealth

Most millionaires in America have one thing in common: real estate holdings. Appreciation allows your home to become a wealth-building vehicle that contributes to your financial future.

Real-Life Example

Imagine you purchase a home for $600,000 in a city where average appreciation is 5% per year. Here’s what your home could be worth in just 5 years:

- Year 1: $630,000

- Year 2: $661,500

- Year 3: $694,575

- Year 4: $729,303

- Year 5: $765,768

That’s $165,000 in appreciation alone—not including the equity you’ve built by paying down your mortgage each month.

Key Takeaway for Buyers

Buying a home isn’t just about having a place to live—it’s about investing in your future. Appreciation, combined with paying down your loan, creates one of the most powerful wealth-building tools available to everyday families.

If you’ve been renting and wondering whether it’s the right time to buy, consider the long-term financial benefits of appreciation. The earlier you start, the sooner you put your money to work for you.

✅ Ready to explore your options?

At Freedom Choice Lending, my team and I are here to guide you through the process so you can buy smart and build wealth with confidence.

👉 Let’s connect today and discuss how homeownership can set you on the path to financial freedom.

Direct Line (562) 281-6163

Main Office (866) 587-6927

David Delgado – NMLS #349079

Presiden/CEO

Freedom Choice Lending

NMLS #1998153

Click Here To Schedule a 15 Loan Consultation Call

Fast Approvals call (562) 281-6163

No Money Down Payment Programs

Reverse Mortgages

FHA

Jumbo

Conventional Elite (Easy to qualify)

97% Conventional Financing

Bank Statements, P&L Only , No Income No Tax Returns

Shop Your Loan With Over 200 Loan Products From The TOP Wholesale Lenders In The Country!

On Time Closings Guaranteed or We Will Pay $1000 penalty fee!*

**Be aware! Online banking fraud is on the rise. If you receive an email containing WIRE TRANSFER INSTRUCTIONS call your escrow officer immediately to verify the information prior to sending funds.**

Need Professional Advisor ?

Need Professional Advisor ?

Leave a Reply