As a mortgage professional who’s helped families for over two decades, I’ve seen one truth stand out again and again: homeownership is the foundation of generational wealth.

If you’re a first-time buyer wondering whether owning a home is really worth it—or if renting is “safer”—this article is for you. Let’s break down what generational wealth means, why it matters, and how buying a home today could set your family up for success tomorrow.

What Is Generational Wealth?

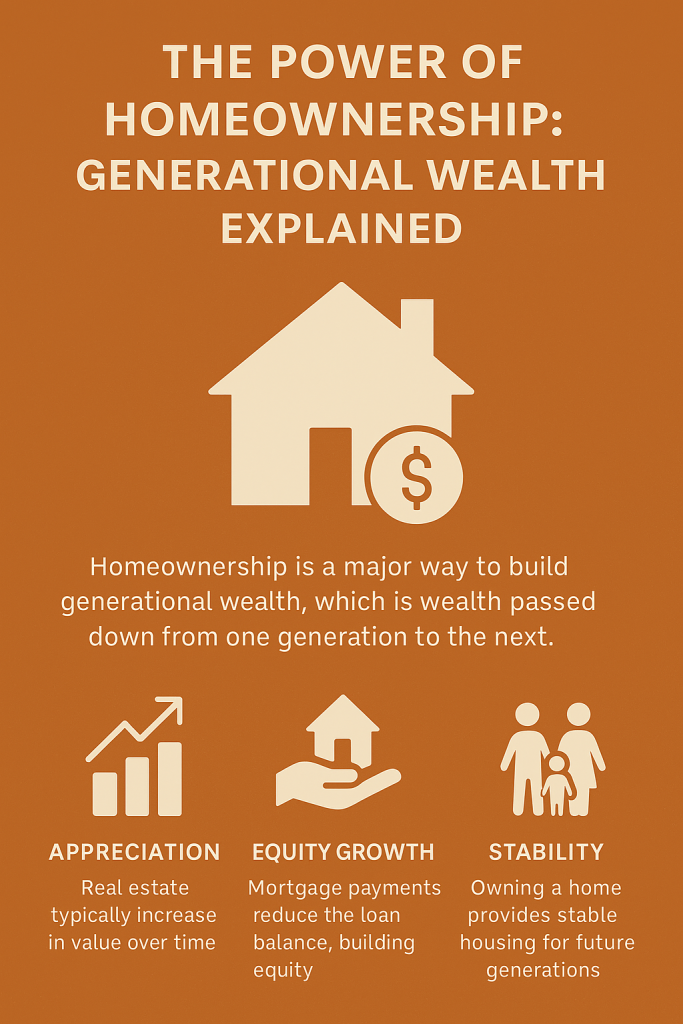

Generational wealth is wealth that gets passed down from one generation to the next. It can be savings, investments, or businesses—but for most families in America, the biggest driver is real estate.

Think about it:

- A renter writes a rent check every month that disappears.

- A homeowner makes a mortgage payment every month that builds equity—ownership in an asset that appreciates over time.

That equity becomes a financial safety net for your family. It’s what allows you to send kids to college, start a business, retire comfortably, or pass something of real value to your children.

Why Homeownership Builds Wealth Faster Than Renting

Here are a few reasons why owning a home has been the most proven wealth-building tool in America:

- Appreciation – Historically, homes in California have appreciated 4–6% annually. That means the home you buy today could be worth hundreds of thousands more in the future.

- Equity Growth – Each mortgage payment reduces your loan balance while your home value rises. That gap is your equity—and it’s wealth you can tap into.

- Fixed Housing Costs – With a fixed-rate mortgage, your monthly payment stays steady while rents continue to rise. Predictability = peace of mind.

- Tax Benefits – Homeowners may deduct mortgage interest and property taxes, lowering their overall tax burden.

A Real-Life Example

Imagine you buy a $600,000 home today with a 5% down payment. Over the next 10 years, if home values grow by 5% annually, that same home could be worth nearly $977,000.

That’s $377,000 in growth—not counting the equity you’ve built by paying down your loan. Compare that to renting, where at the end of 10 years, you have nothing to show for it.

Why This Matters for the Next Generation

Homeownership doesn’t just create wealth for you—it changes the trajectory for your family.

- Your kids grow up with stability.

- You leave behind an appreciating asset instead of a history of rent payments.

- You create opportunities that ripple through future generations.

Owning a home is more than just having a place to live—it’s planting a financial tree that your children and grandchildren can benefit from.

The First Step: Getting Educated

Many renters believe they need 20% down or perfect credit to buy a home. The truth? There are loan programs that allow you to get started with as little as 3–5% down.

That’s where I come in. As part of Freedom Choice Lending, my mission is to make the path to homeownership clear and achievable. Whether you’re ready now or just want to explore your options, I’ll help you map out a plan to buy smart, build equity, and start creating generational wealth.

Final Thoughts

Renting might feel comfortable today, but it rarely builds wealth. Homeownership is the key to unlocking financial freedom for you and your family.

If you’re ready to take the first step toward building generational wealth, let’s talk.

👉 Schedule a free consultation today with Freedom Choice Lending, and discover how close you are to holding the keys to your future.

Direct Line (562) 281-6163

Main Office (866) 587-6927

David Delgado – NMLS #349079

Presiden/CEO

Freedom Choice Lending

NMLS #1998153

Click Here To Schedule a 15 Loan Consultation Call

Fast Approvals call (562) 281-6163

No Money Down Payment Programs

Reverse Mortgages

FHA

Jumbo

Conventional Elite (Easy to qualify)

97% Conventional Financing

Bank Statements, P&L Only , No Income No Tax Returns

Shop Your Loan With Over 200 Loan Products From The TOP Wholesale Lenders In The Country!

On Time Closings Guaranteed or We Will Pay $1000 penalty fee!*

**Be aware! Online banking fraud is on the rise. If you receive an email containing WIRE TRANSFER INSTRUCTIONS call your escrow officer immediately to verify the information prior to sending funds.**

Need Professional Advisor ?

Need Professional Advisor ?

Leave a Reply