As of June 2025, the average home value in Whittier, CA, stands at approximately $824,074, reflecting a 3.5% increase over the past year . With mortgage interest rates around 6.25%, prospective homeowners are evaluating the long-term financial implications of buying versus renting.

📈 Home Price Appreciation Forecast

Historical data indicates that Whittier’s real estate market has experienced consistent growth. Over the past decade, the city saw a cumulative appreciation rate of 91.72%, averaging 6.73% annually . Assuming a conservative annual appreciation rate of 6.5%, the projected home values over the next nine years are as follows

| Year | Projected Home Value |

|---|---|

| 2025 | $824,074 |

| 2026 | $877,718 |

| 2027 | $934,791 |

| 2028 | $995,553 |

| 2029 | $1,060,281 |

| 2030 | $1,129,271 |

| 2031 | $1,202,837 |

| 2032 | $1,281,317 |

| 2033 | $1,365,071 |

| 2034 | $1,454,490 |

🏠 Buying: 9-Year Financial Overview

Assumptions:

- Home Price: $824,074

- Down Payment: 20% ($164,815)

- Loan Amount: $659,259

- Interest Rate: 6.25% (30-year fixed)

- Monthly Mortgage Payment: Approximately $4,060 (Principal & Interest)

- Property Taxes & Insurance: Approximately $1,000/month

- Total Monthly Payment: Approximately $5,060

9-Year Equity Accumulation:

- Principal Paid: Approximately $100,000

- Home Value Increase: Approximately $630,416

- Total Equity: Approximately $730,416

🏘️ Renting: 9-Year Financial Overview

Assumptions:

- Initial Monthly Rent: $2,970

- Annual Rent Increase: 3%

9-Year Rent Payments:

- Total Rent Paid: Approximately $350,000

- Equity Accumulated: $0

📊 Rent vs. Buy: 9-Year Cost Comparison

| Category | Buying | Renting |

|---|---|---|

| Total Payments | $546,480 | ~$350,000 |

| Equity Accumulated | $730,416 | $0 |

| Net Gain/Loss | +$183,936 | -$350,000 |

Note: These figures are estimates and actual costs may vary based on individual circumstances.Best Places

📝 Conclusion

While renting may offer lower monthly payments initially, buying a home in Whittier, CA, presents a substantial opportunity for long-term equity growth. With projected home value appreciations and equity accumulation, purchasing a home could result in significant financial benefits over a nine-year period.

For personalized advice tailored to your financial situation, consider consulting with a mortgage professional or financial advisor.

To start a loan application online go to fcl.amloa.org or text the word Apply to 562-451-8883

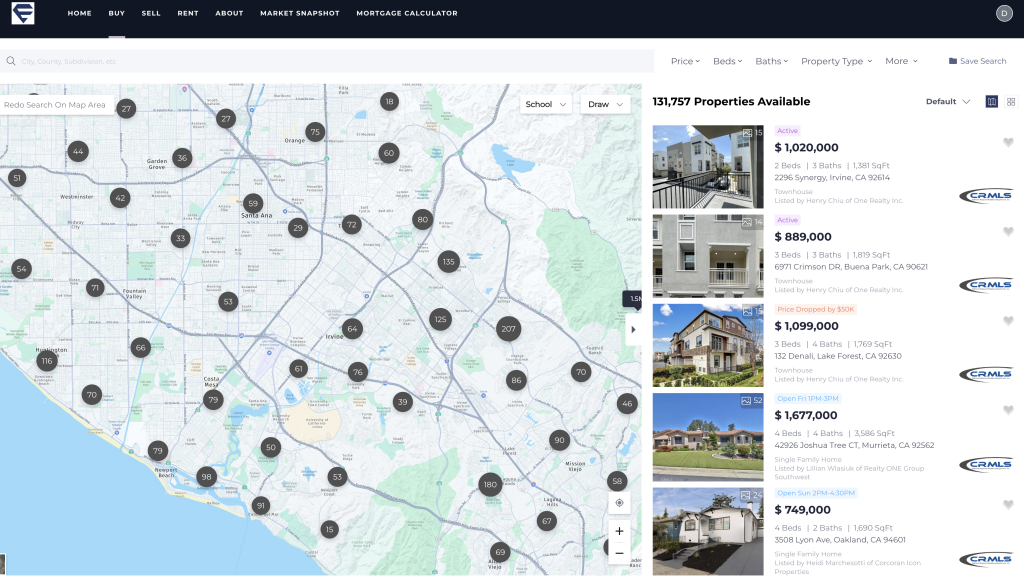

To get a Free List of bank foreclosures, company owned homes and other distress sales go to www.SearchAnyHomeOnline.com

David Delgado – NMLS #349079

President/CEO

Main Office (866) 587-6927

Freedom Choice Lending

NMLS #1998153

If you know any friends, family members, co-workers looking to buy, sell or refinance it would be an honor to help them as well. When you come across anyone please give us a call at 866-587-6927 Thank you! David Delgado

Need Professional Advisor ?

Need Professional Advisor ?