If you’re debating whether to buy or rent in Chino, CA, you’re not alone. With home prices hovering around $799,000 and mortgage rates averaging 6.25% (APR 6.397%) for 95% conventional loans, it’s important to weigh the long-term benefits of ownership versus the flexibility of renting.

Let’s break it down with some realistic numbers.

📊 Home Purchase Scenario

- Home Price: $799,000

- Down Payment (5%): $39,950

- Loan Amount: $759,050

- Interest Rate: 6.25%

- APR: 6.397%

- Loan Term: 30 years (fixed)

- Forecasted Appreciation: 5.18% annually over 9 years

Monthly Costs:

- Principal & Interest: ~$4,671

- Property Taxes (1.25% est.): ~$832/month

- Home Insurance: ~$100/month

- PMI (Private Mortgage Insurance): ~$270/month (estimated)

- Total Estimated Monthly Cost: ~$5,873

📉 Renting the Same Home

A comparable rental in Chino might cost around $3,400/month, depending on size and amenities. Renting avoids many of the costs tied to homeownership (repairs, taxes, insurance, PMI).

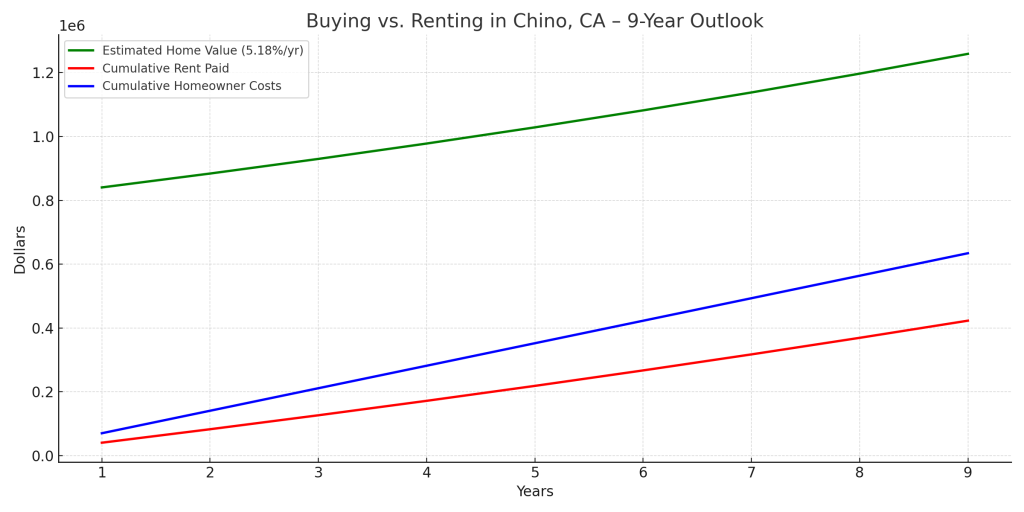

💰 9-Year Financial Picture

Buying:

- Total Mortgage Payments (9 yrs): ~$504,000

- Total Estimated Costs (including tax, PMI, insurance): ~$635,000

- Home Value After 9 Years (5.18% appreciation):

≈ $1,291,500 - Equity Gained (including loan principal paid): ≈ $613,000

Renting:

- Total Rent Paid (9 yrs @ 3.5% annual increase): ≈ $393,000

- Equity Gained: $0

🧮 Net Benefit of Buying

If you sell the home in 9 years (minus ~7% selling costs):

- Net Sales Proceeds: ≈ $1,200,000

- Remaining Loan Balance: ≈ $638,000

- Net Equity After Sale: ≈ $562,000

Even after paying more per month, buying results in substantial wealth building through appreciation and equity.

✅ Final Verdict: Buy or Rent?

If you plan to stay in Chino for at least 7–9 years, buying makes strong financial sense. Yes, the monthly payment is higher, but you’re building equity in a rapidly appreciating market (5.18% annually). Renting, while cheaper short-term, results in no long-term return.

Need Professional Advisor ?

Need Professional Advisor ?